Introduction

In the world of real estate investing, Ashcroft Capital has been a name that many investors trusted for years. Known for its focus on multifamily properties—apartment complexes that generate rental income the company promised steady returns and long-term growth. However, in recent times, Ashcroft Capital has found itself at the center of a major legal controversy: the Ashcroft Capital lawsuit. This lawsuit has caught the attention of investors, industry experts, and regulators alike, raising questions about transparency, trust, and the risks of real estate investments.

If you’re new to real estate investing or just curious about this case, don’t worry—this article will break it all down in simple, easy-to-understand language. We’ll explore what Ashcroft Capital is, why the lawsuit happened, what the allegations are, how it’s affecting investors, and what it means for the future of real estate investing. By the end, you’ll have a clear picture of this complex situation and some practical tips to protect yourself as an investor. Let’s dive in!

What Is Ashcroft Capital?

Before we get into the lawsuit, let’s start with the basics: what is Ashcroft Capital? Founded by Joe Fairless and Frank Roessler, Ashcroft Capital is a real estate investment firm based in the United States. The company specializes in multifamily properties, which are large apartment buildings or complexes where many people live and pay rent. Ashcroft’s business model is called a value-add strategy. This means they buy apartment buildings that need some work, fix them up (think new kitchens, better amenities, or modern designs), and then raise the rent to make more money. The goal is to increase the property’s value over time and give investors a good return on their money.

Ashcroft Capital works with both individual investors (people like you and me) and big institutions (like banks or investment funds). They’ve built a strong reputation by managing billions of dollars in real estate assets across states like Texas, Florida, and other fast-growing areas in the U.S. Their promise? Passive income—money that comes in without you having to manage the properties yourself—and the chance for your investment to grow as property values rise.

For years, Ashcroft Capital seemed like a reliable choice. They attracted thousands of investors with their professional marketing, a popular real estate podcast hosted by Joe Fairless, and a track record of successful deals. But as we’ll see, not everything went as planned, leading to the lawsuit that’s now making headlines.

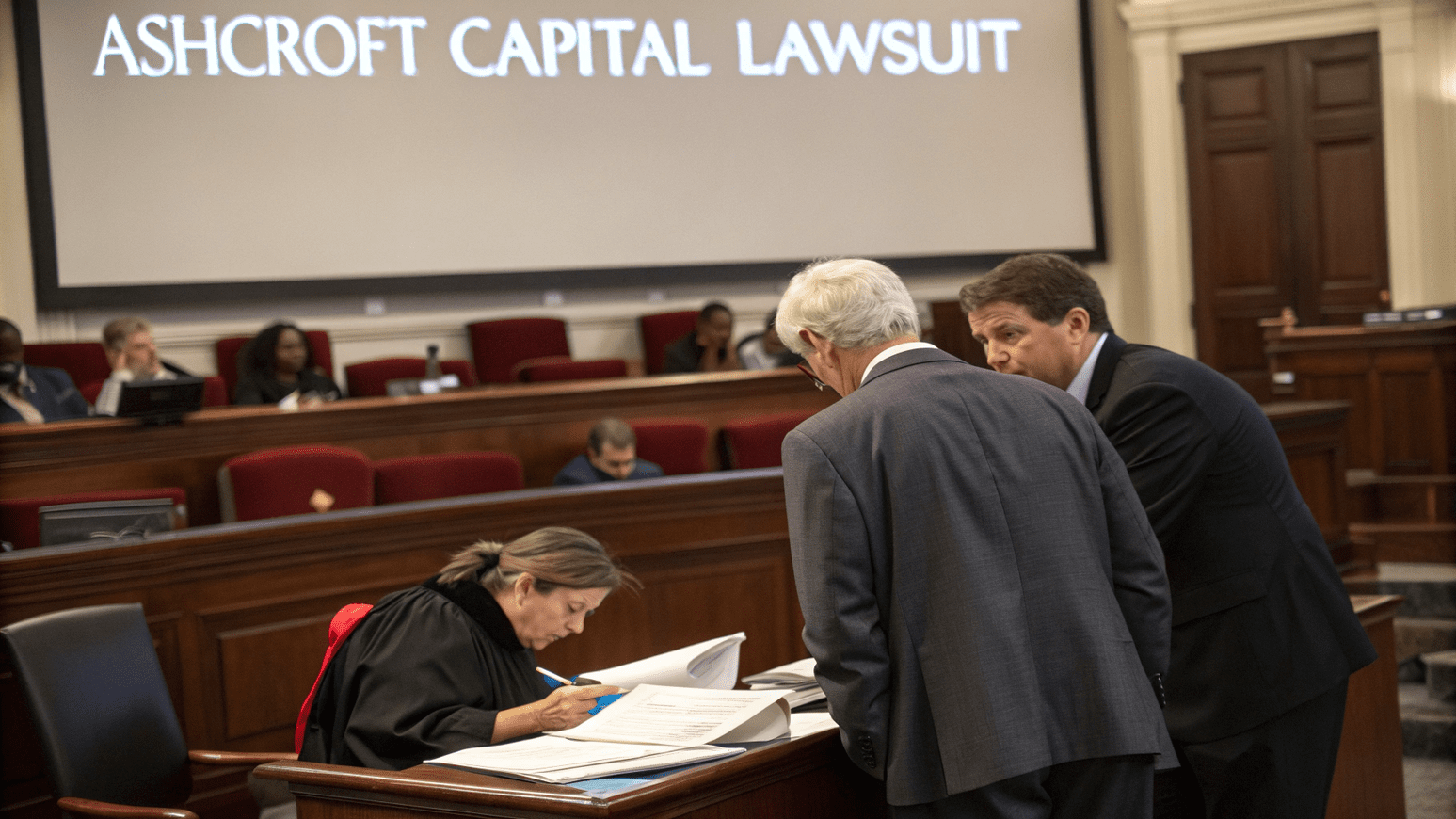

The Ashcroft Capital Lawsuit: What’s It All About?

The Ashcroft Capital lawsuit is a legal battle between the company and a group of investors who claim they were misled or mistreated. The lawsuit started gaining attention in 2024 and, as of April 2025, is still ongoing. While the exact details are still unfolding (lawsuits can take a long time!), here’s what we know so far based on reports and discussions in places like Reddit, BiggerPockets, and industry news sites.

Why Did the Lawsuit Happen?

The lawsuit stems from a combination of factors, but it all boils down to one main issue: investor dissatisfaction. Many investors who put their money into Ashcroft Capital’s deals expected good returns, but some of their investments didn’t perform as promised. This led to frustration, especially when the company made decisions that investors felt were unfair or risky.

Here are some of the key events that set the stage for the lawsuit:

- Paused Distributions: In November 2023, Ashcroft Capital announced it would pause distributions (stop paying out profits) to investors in one of its funds, called the Value-Add Fund I. The reason? Rising costs for rate caps—a type of financial protection that keeps loan interest rates from spiking. When Ashcroft took out loans in 2021, rate caps cost $513,000. By 2023, replacing them would cost a whopping $18.6 million! This cash crunch meant the company couldn’t pay investors as planned, which upset many of them.

- Capital Calls: In April 2024, Ashcroft sent a surprise email to investors, asking for an additional 19.7% of their original investment to keep a property called Elliot Roswell afloat. This is called a capital call, where investors are asked to put in more money to cover unexpected costs. Many investors were shocked—they felt like they were being asked to throw good money after bad, especially since distributions were already paused.

- Underperforming Properties: Some of Ashcroft’s properties, especially in places like Atlanta, weren’t doing as well as expected. Slow leasing (fewer people renting apartments) and bad debt (tenants not paying rent) hurt the company’s profits. Investors started to question whether Ashcroft’s projections—the rosy promises of high returns—were realistic to begin with.

These issues, combined with a tough real estate market (rising interest rates and slower rent growth), created a perfect storm. Investors felt misled, and some decided to take legal action to get answers and, potentially, their money back.

Key Allegations in the Lawsuit

The investors suing Ashcroft Capital have made several serious claims. These allegations are the heart of the lawsuit and explain why they’re so upset. Here’s a breakdown of the main accusations, explained in simple terms:

- Misrepresentation of Risks: Investors say Ashcroft Capital didn’t clearly explain the risks of their investments. For example, they claim the company’s marketing materials made it sound like returns were almost guaranteed, even though real estate always has risks like market downturns or unexpected costs.

- Overly Optimistic Projections: The lawsuit alleges that Ashcroft painted an unrealistic picture of how much money investors could make. Some investors say the company used inflated property valuations—claiming properties were worth more than they actually were—to attract more money.

- Breach of Fiduciary Duty: As a company managing other people’s money, Ashcroft Capital has a legal responsibility to act in its investors’ best interests. The plaintiffs claim Ashcroft put its own profits first—for example, by charging high fees or making risky financial decisions that benefited the company more than the investors.

- Lack of Transparency: Investors argue they weren’t given enough information about how their money was being used. For instance, some say Ashcroft didn’t share enough details about financial performance, expenses, or the challenges facing their properties.

- Financial Mismanagement: There are claims that Ashcroft didn’t handle investor funds properly. Some plaintiffs allege the company diverted money to unauthorized projects or used it in ways that weren’t agreed upon. In one report, a financial expert suggested that up to $78 million may have been misused, though this hasn’t been proven yet.

- Hidden Fees: Some investors say Ashcroft charged fees—like management fees or acquisition fees—that weren’t clearly disclosed in the investment documents. This made it feel like the company was taking more money than it should have.

It’s important to note that these are allegations, not proven facts. Ashcroft Capital has denied doing anything wrong and is fighting the lawsuit in court. The legal process will determine whether these claims hold up.

Who’s Involved in the Lawsuit?

The Ashcroft Capital lawsuit involves several key players, each with their own role in the drama. Let’s meet them:

- Ashcroft Capital: The company itself is the main defendant. Founded by Joe Fairless and Frank Roessler, it’s a well-known name in real estate syndication (a way of pooling money from many investors to buy properties).

- Joe Fairless and Frank Roessler: These co-founders are in the spotlight because their leadership decisions are being questioned. Joe, in particular, is a public figure thanks to his podcast, The Best Real Estate Investing Advice Ever Show. Investors are watching to see how they respond to the allegations.

- The Plaintiffs: This is the group of investors suing Ashcroft. They include both individual investors (people who invested their personal savings) and institutional investors (big organizations with lots of money). One notable plaintiff is Jonathan Merrick, a former real estate investment banker with 25 years of experience, whose involvement gives the lawsuit extra credibility.

- Legal Teams: Both sides have hired experienced lawyers to argue their case. The plaintiffs’ lawyers are presenting evidence like emails, financial documents, and statements from former employees to support their claims. Ashcroft’s lawyers are arguing that investors were informed of the risks and that market conditions, not mismanagement, caused the problems.

- Regulators: The Securities and Exchange Commission (SEC) and other regulatory bodies are reportedly keeping an eye on the case. If they find evidence of securities fraud or violations of investment laws, they could step in with their own investigations or penalties.

- Investors and Industry Watchers: Beyond the people directly involved, thousands of other investors, real estate professionals, and analysts are following the case. They want to know how it will affect Ashcroft Capital and the broader real estate investment industry.

How Did We Get Here? The Bigger Picture

To understand why the Ashcroft Capital lawsuit is such a big deal, we need to zoom out and look at the broader real estate market. The early 2020s were a wild time for real estate, especially for multifamily properties. Here’s a quick recap of what was happening:

- Boom Times: After the COVID-19 pandemic, the U.S. real estate market went into overdrive. People were moving to fast-growing areas like Texas and Florida, driving up demand for apartments. Low interest rates made it cheap to borrow money, so companies like Ashcroft Capital took out big loans to buy properties. Investors poured money into these deals, expecting high returns.

- Rising Interest Rates: The Federal Reserve started raising interest rates to fight inflation, making loans more expensive. This hit real estate companies hard, especially those with floating-rate loans (loans where the interest rate can go up). Ashcroft’s rate cap issue was a direct result of this—it became super expensive to protect against rising rates.

- Cooling Market: By 2023, the real estate market started to slow down. New apartment buildings were flooding the market, making it harder to fill units and raise rents. Some of Ashcroft’s properties struggled with low occupancy and unpaid rent, which hurt their profits.

- Investor Expectations vs. Reality: During the boom, many investors got used to quick profits and easy money. When things got tough, they were shocked to see distributions paused or capital calls announced. This gap between what they expected and what actually happened fueled the anger behind the lawsuit.

Ashcroft Capital wasn’t the only company facing these challenges—other real estate syndicators were struggling too. But Ashcroft’s high profile, thanks to its marketing and podcast, made it a bigger target for criticism.

What’s Happening Now? The Legal Process

As of April 2025, the Ashcroft Capital lawsuit is still in its early stages. Lawsuits like this can take months or even years to resolve, so there’s no final answer yet on who’s right or wrong. Here’s where things stand:

- Filing and Discovery: The plaintiffs have filed their complaints in federal and state courts, and some are pushing for class-action status (a lawsuit that represents a large group of investors). Both sides are now in the discovery phase, where they exchange documents, emails, and other evidence to build their cases.

- Pre-Trial Motions: Before the case goes to trial, lawyers on both sides are filing motions (legal requests) to shape the case. For example, Ashcroft’s team might ask to dismiss certain claims, while the plaintiffs might ask for more access to the company’s financial records.

- Settlement Talks: There are reports that Ashcroft Capital and the plaintiffs are discussing a possible settlement—an agreement where the company might pay the investors to avoid a full trial. No deal has been confirmed, but settlements are common in cases like this because they save time and money.

- SEC Scrutiny: The SEC is reportedly reviewing the case to see if Ashcroft violated any securities laws, like those under Regulation D (rules for private investments). If the SEC gets involved, it could lead to bigger consequences for Ashcroft, like fines or stricter rules.

- Ashcroft’s Response: Ashcroft Capital has denied all allegations, saying it operated legally and ethically. The company claims that all investors were accredited (meaning they were experienced and understood the risks) and that market conditions, not mismanagement, caused the problems. They’re also conducting an internal audit to review their practices and are communicating with investors to rebuild trust.

The coming months will be critical. If the case goes to trial, a judge or jury will decide whether Ashcroft is liable. If a settlement is reached, investors might get some money back, but the details will depend on the agreement.

How Is the Lawsuit Affecting Investors?

The Ashcroft Capital lawsuit is having a big impact on investors, both those directly involved and those watching from the sidelines. Here’s a look at the main effects:

Financial Impacts

- Paused Distributions: Investors in Ashcroft’s Value-Add Fund I and other deals aren’t getting the regular payouts they expected, which can hurt their financial plans. For some, this was supposed to be passive income to cover living expenses or retirement.

- Capital Calls: The 19.7% capital call for Elliot Roswell means investors have to put in more money or risk losing their entire investment if the property is sold at a loss. This has left many feeling trapped.

- Potential Losses: If the lawsuit proves that Ashcroft mismanaged funds or inflated valuations, investors could face permanent losses. Even if they win the case, they might not get all their money back.

- Legal Costs: Ashcroft Capital is spending a lot on legal fees to defend itself. These costs could eat into the company’s profits, which might mean less money for investors in the long run.

Emotional and Trust Issues

- Loss of Confidence: Many investors feel betrayed, especially those who trusted Ashcroft’s marketing and podcast. Online forums like Reddit and BiggerPockets are full of angry posts from investors who say they’ll never invest with Ashcroft again.

- Fear of Future Investments: The lawsuit is making investors more cautious about real estate syndications in general. Some are worried that other companies might have similar problems, leading to a broader loss of trust in the industry.

- Stress and Uncertainty: For investors who put in large sums of money, the lawsuit is a source of stress. They’re worried about losing their savings and don’t know how long it will take to get answers.

What Can Investors Do?

If you’re an investor with Ashcroft Capital, here are some steps you can take:

- Review Your Documents: Look at your investment agreement and the Private Placement Memorandum (PPM)—the document that explains the deal’s terms and risks. This will help you understand your rights and what Ashcroft promised.

- Talk to a Lawyer: A real estate or securities lawyer can review your case and tell you if you should join the lawsuit or take other actions. Legal advice is especially important if you’re facing a capital call.

- Stay Informed: Follow updates from Ashcroft Capital and check trusted sources like court filings or news sites for the latest on the lawsuit. Avoid relying on rumors or unverified posts on social media.

- Don’t Panic: Lawsuits don’t always mean a company is doomed. Ashcroft is still operating and managing properties, so your investment might still recover. Make decisions based on facts, not fear.

- Diversify: If you have a lot of money tied up with Ashcroft, consider spreading your investments across different companies or asset types (like stocks or bonds) to reduce risk in the future.

What Could Happen Next? Possible Outcomes

The Ashcroft Capital lawsuit could go in several directions, and each outcome would have different consequences for the company, investors, and the real estate industry. Here are the main possibilities:

- Settlement:

- What It Means: Ashcroft Capital and the plaintiffs agree to a deal, usually involving the company paying investors some money without admitting guilt.

- Pros: Investors might get some compensation, and the case wraps up faster than a trial. Ashcroft avoids a long legal battle and can focus on its business.

- Cons: The payout might be less than what investors lost, and there’s no guarantee everyone will be happy with the deal.

- Likelihood: Settlements are common in lawsuits like this, so this is a strong possibility.

- Court Ruling for Investors:

- What It Means: The court finds Ashcroft Capital guilty of some or all of the allegations, like fraud or breach of fiduciary duty. The company might have to pay big fines, compensate investors, or change how it operates.

- Pros: Investors could get a larger payout, and the ruling might force Ashcroft to be more transparent in the future.

- Cons: Ashcroft might struggle financially, which could hurt its ability to manage properties and pay other investors. The company’s reputation would take a big hit.

- Likelihood: This depends on the strength of the plaintiffs’ evidence. Proving fraud or mismanagement is hard, so it’s not guaranteed.

- Court Ruling for Ashcroft:

- What It Means: The court decides Ashcroft didn’t do anything wrong, and the case is dismissed.

- Pros: Ashcroft can move forward without penalties, and investors who stuck with the company might feel more confident. The company’s reputation could recover over time.

- Cons: Investors who sued might get nothing, and some could lose trust in the legal system. It might also mean fewer changes to how Ashcroft operates.

- Likelihood: If Ashcroft’s lawyers can prove that investors were informed of the risks and that market conditions caused the losses, this is possible.

- SEC or Regulatory Action:

- What It Means: The SEC or another regulator steps in, either because of the lawsuit or their own investigation. They could fine Ashcroft, impose new rules, or even shut down parts of its business if they find serious violations.

- Pros: This could lead to broader reforms in the real estate industry, making it safer for investors in the future.

- Cons: It could disrupt Ashcroft’s operations, affecting all investors, not just those in the lawsuit. It might also make it harder for other real estate firms to raise money.

- Likelihood: The SEC is already watching, so some regulatory action is possible, but it’s unlikely to happen quickly.

- Bankruptcy or Restructuring:

- What It Means: If Ashcroft Capital can’t handle the financial strain of the lawsuit, capital calls, and underperforming properties, it might have to file for bankruptcy or restructure its business.

- Pros: Restructuring could help the company survive and protect some investor money. Bankruptcy might allow for an organized way to pay back investors.

- Cons: Investors could lose a lot of their money, and the company’s reputation would be severely damaged.

- Likelihood: This is less likely, as Ashcroft is still operating and recently announced a recapitalization (a way of restructuring a deal) for a property called the Avery. But it’s a risk if things get worse.

What Does This Mean for the Real Estate Industry?

The Ashcroft Capital lawsuit isn’t just about one company—it’s raising big questions about how the entire real estate investment industry works. Here are some of the broader impacts:

- More Scrutiny on Syndicators:

- Real estate syndication—where companies like Ashcroft pool money from many investors—is under the microscope. Investors and regulators are demanding more transparency about risks, fees, and how money is used. This could lead to stricter rules for all syndicators.

- Investor Caution:

- The lawsuit is making investors think twice before putting money into real estate deals. People are starting to ask harder questions and do more research, which is good but could slow down investment in the industry.

- Push for Transparency:

- The allegations about hidden fees and lack of communication are pushing the industry to be more open. Companies might start sharing more detailed financial reports or hiring independent auditors to build trust.

- Legal Precedents:

- If the lawsuit results in a big court ruling or SEC action, it could set new standards for how real estate firms operate. For example, there might be clearer rules about how to disclose risks or handle investor funds.

- Market Shifts:

- The real estate market is already changing, with slower rent growth and higher interest rates. The lawsuit could make it harder for companies like Ashcroft to raise money, which might lead to fewer deals or more conservative strategies.

This case is a wake-up call for the industry. It’s showing that even well-known companies can face serious challenges, and investors need to be proactive about protecting their money.

Lessons for Investors: How to Protect Yourself

The Ashcroft Capital lawsuit offers some valuable lessons for anyone thinking about investing in real estate—or any investment, for that matter. Here are some practical tips to keep your money safe:

- Do Your Homework (Due Diligence):

- Before investing, research the company thoroughly. Look at their track record, especially how they’ve handled tough times. Check online reviews, talk to other investors, and read the Private Placement Memorandum (PPM) carefully.

- Understand the Risks:

- No investment is risk-free. Real estate can be affected by market changes, interest rates, or unexpected costs. Make sure you’re comfortable with the worst-case scenario before investing.

- Ask Tough Questions:

- Don’t be afraid to grill the company about their plans, fees, and risks. Ask things like: “What happens if the market crashes?” or “How much are you charging in fees?” A good company will be happy to answer.

- Work with Professionals:

- Hire a financial advisor or real estate lawyer to review the investment. They can spot red flags you might miss and help you understand the fine print.

- Stay Engaged:

- Don’t just hand over your money and forget about it. Keep track of how your investment is doing, read updates from the company, and ask questions if something seems off.

- Diversify Your Investments:

- Don’t put all your money in one company or one type of investment. Spread it across different real estate firms, stocks, bonds, or other assets to reduce risk.

- Beware of Hype:

- Be cautious of companies that promise huge returns or use flashy marketing. If it sounds too goodанной

good to be true, it probably is. Trust companies that are upfront about risks and have a solid track record.

Conclusion: A Cautionary Tale

The Ashcroft Capital lawsuit is more than just a legal dispute—it’s a reminder of the risks and responsibilities that come with investing. Ashcroft Capital, once a darling of the real estate world, is now fighting to defend its reputation and prove it did right by its investors. Whether the allegations are true or not, this case highlights the importance of transparency, trust, and doing your homework before investing.

For investors, the lawsuit is a chance to learn and grow. It’s a reminder to ask questions, read the fine print, and never assume an investment is a sure thing. For the real estate industry, it’s a push to be more open and accountable, which could lead to better protections for everyone.

As the lawsuit unfolds, keep an eye on updates from trusted sources like court filings, news sites, or Ashcroft Capital itself. The outcome could shape the future of real estate investing, setting new standards for how companies and investors work together. For now, the lesson is clear: trust, but verify. Your money deserves it.

FAQs of Ashcroft capital lawsuit

1. What is the Ashcroft Capital lawsuit about?

Investors claim Ashcroft Capital misled them with unrealistic projections and mismanaged funds.

2. Why did Ashcroft pause distributions in 2023?

Rising costs for rate caps, from $513,000 to $18.6 million, strained finances.

3. What is a capital call in the lawsuit context?

Ashcroft asked investors for 19.7% more funds to support the Elliot Roswell property.

4. Who are the key players in the lawsuit?

Ashcroft Capital, founders Joe Fairless and Frank Roessler, and suing investors.

5. How might the lawsuit affect Ashcroft investors?

Investors face paused payouts, potential losses, and uncertainty about returns.

6. What could happen next in the lawsuit?

Possible outcomes include a settlement, court ruling, or SEC regulatory action.

Also Read It:

Is MNGT 6320.795 Easy? A Comprehensive Guide

Ssc Office Of Small Business Programs Tameika Wanzo

Exploring Niqqui0408: A Deep Dive into Digital Culture

Exploring hcooch ch2 h2o in Chemistry

fort worth mesothelioma lawyer vimeo – Legal Help, Awareness & Support